About

Us

Trusted by Customers

WhatsApp Us

0

Established

0

Customers Globally

0

+ Experts

TOP

0

Global Fintech Vendors

Vast experience in Retail, Corporate and Business banking

Globally Recognized

All News

What Makes Us Special

Omnichannel

Business

Solutions

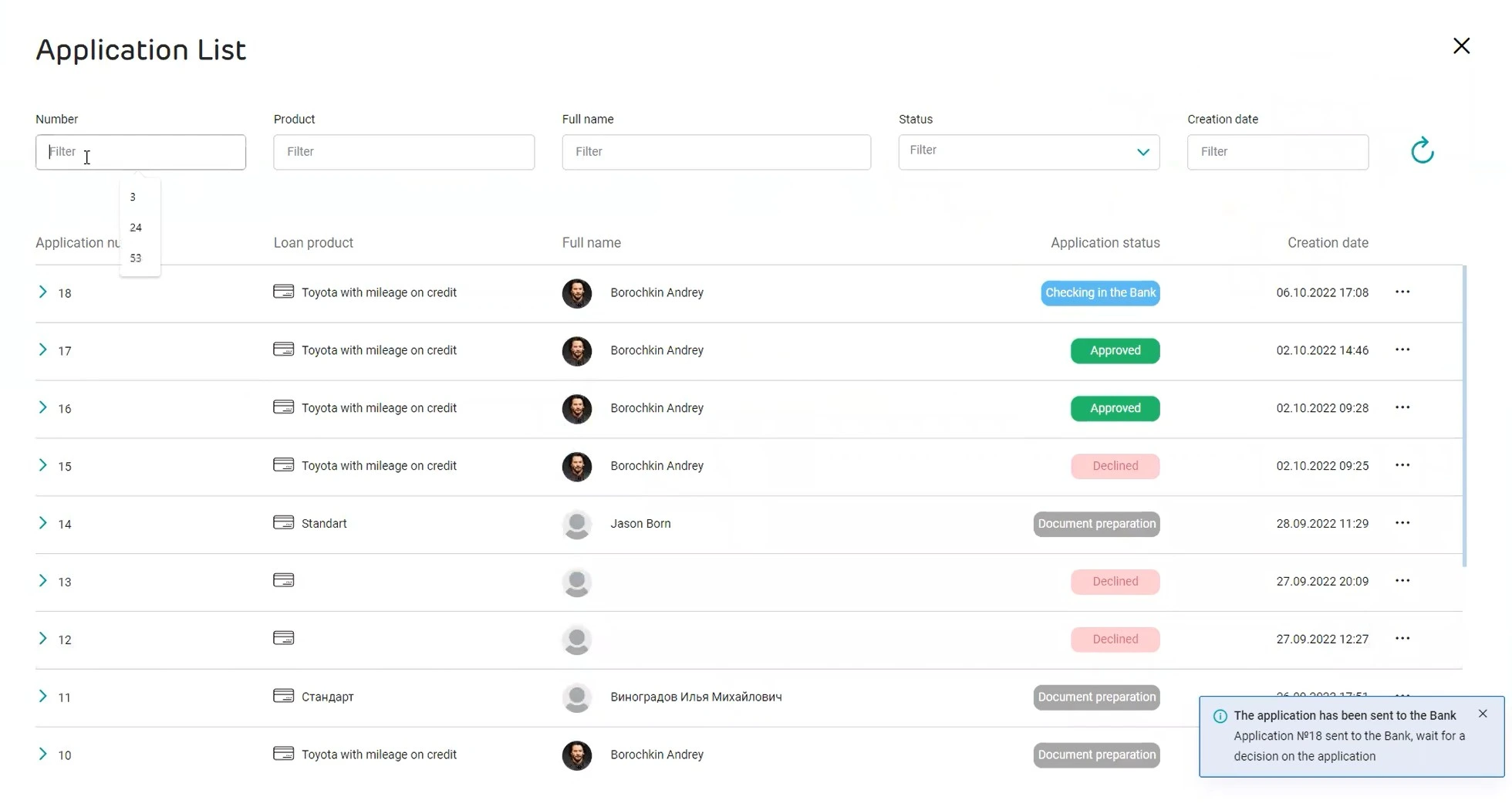

Lending made easy, auto loans, mortgages, MSB and corporate lending

- Implement a fully digital loan origination process

- Ensure end-to-end loan origination, decision-making, scoring and disbursal

- Support all types of loans

Enhance your existing lending solutions with the advanced Decision-Making System and Product Factory

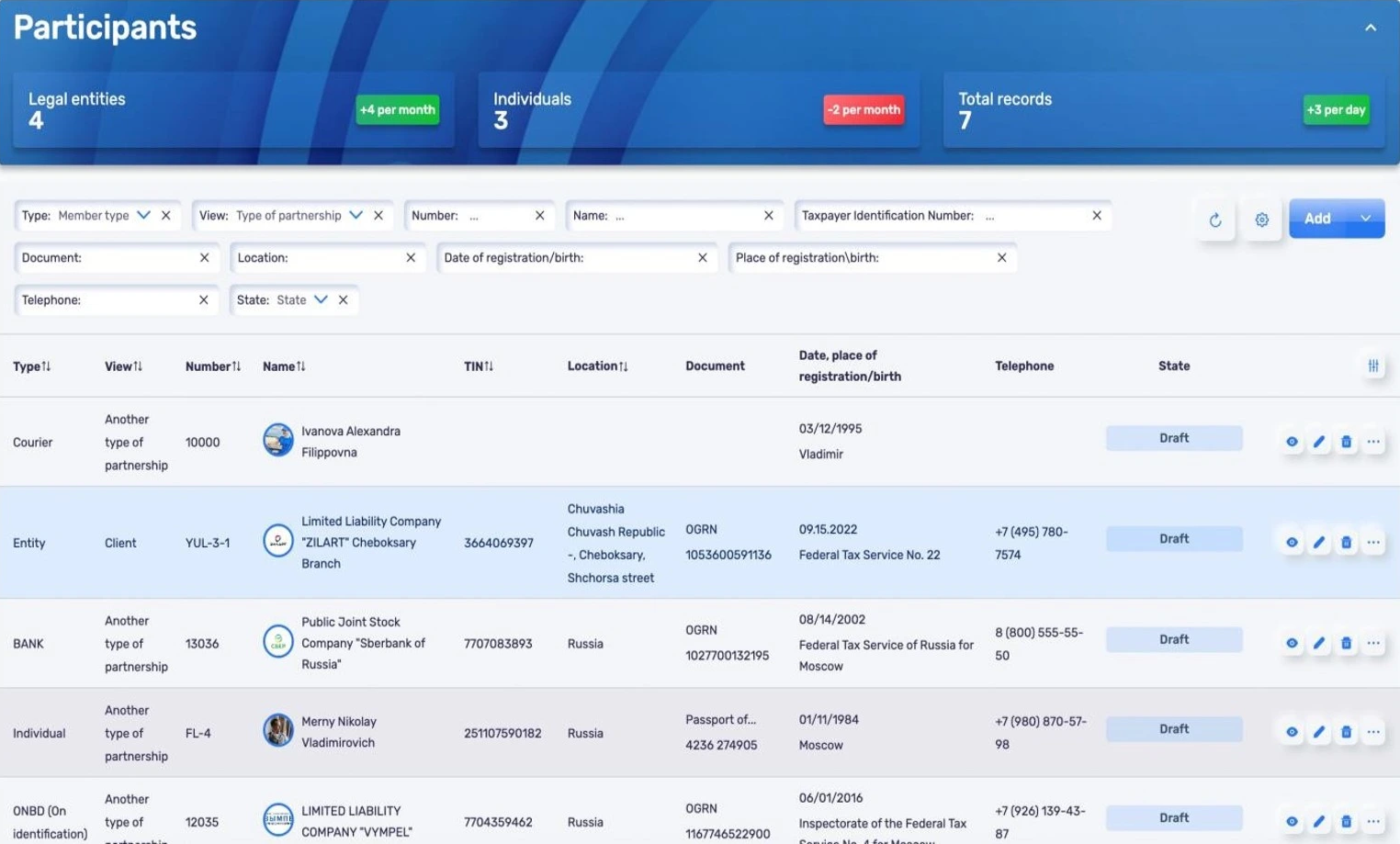

Individual and corporate customers, online and mobile banking

- Self-service banking for retail and business customers

- Consistent CX in all modern channels and touchpoints (online and mobile)

- Low-code tools to compose new channels easily

- Added value through partner ecosystems and marketplaces

Ensure omnichannel customer support with the single layer of business processes based on Digital Q.BPM

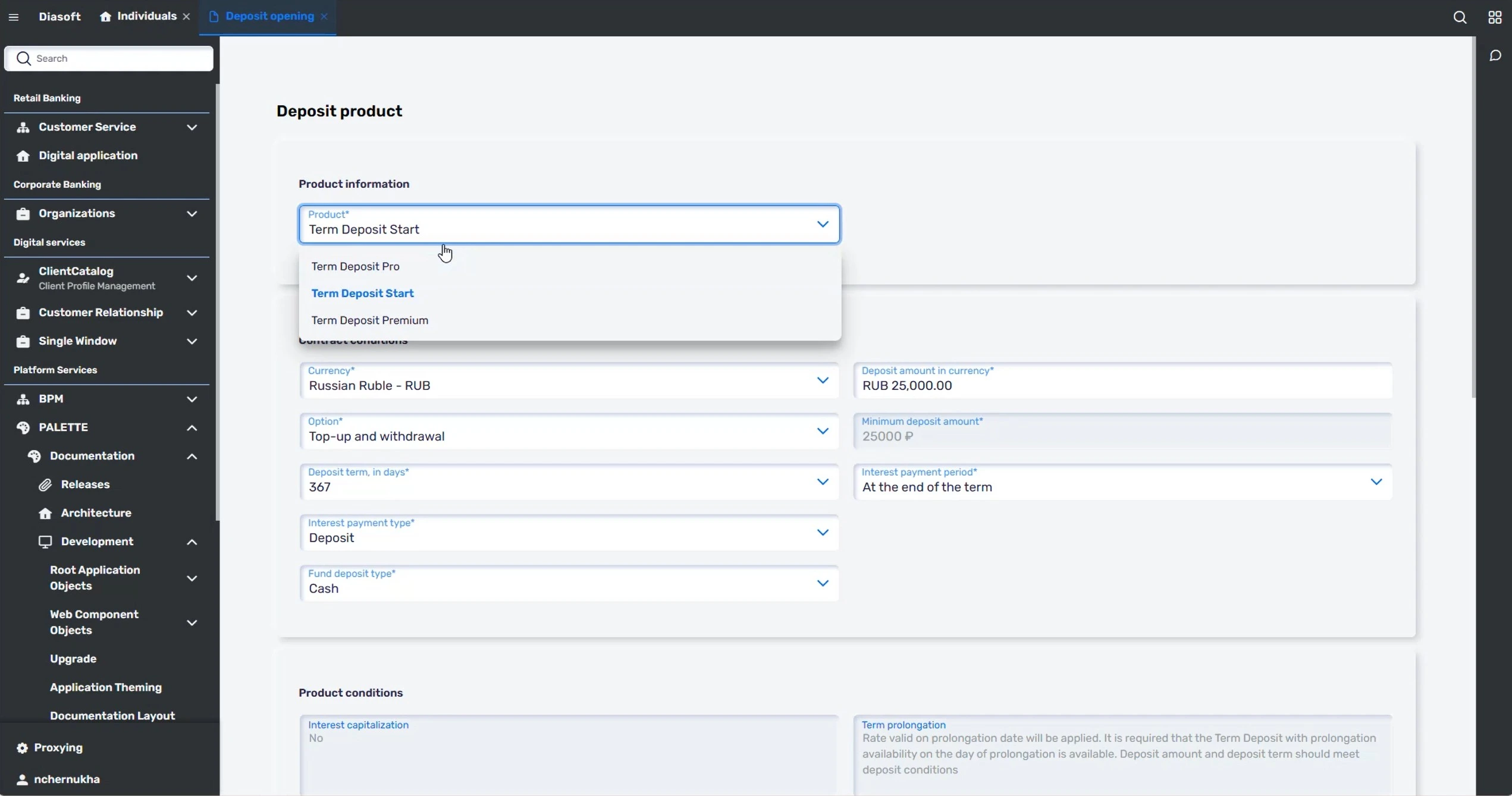

Retail and business banking:

teller, sale of bank products,

current and deposit accounts, cards

teller, sale of bank products,

current and deposit accounts, cards

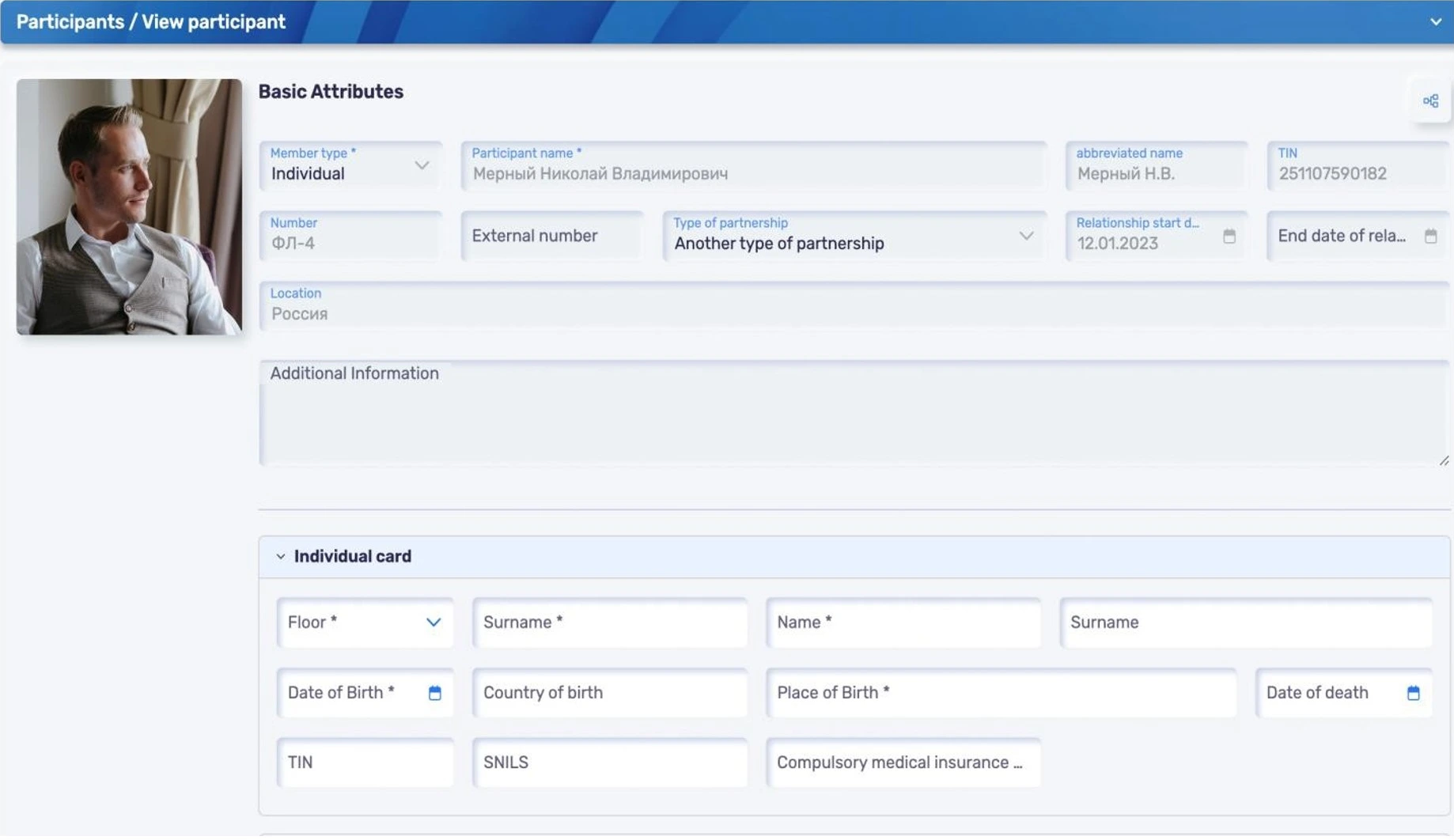

- Speed up routine teller services with the single view of customers, products and services

- Improve sale and cross-sale of bank products

- Enhance traditional banking with fully digital sales of products in online and mobile apps

- Support fully digital lending

Accelerate your existing banking suite with innovative core-agnostic Product Factory and 360° Customer View

Digital

Accelerators

Boost your existing digital solutions, customer services and product management processes by adding cutting-edge digital components. Personalize and improve banking experience at branches and digital channels

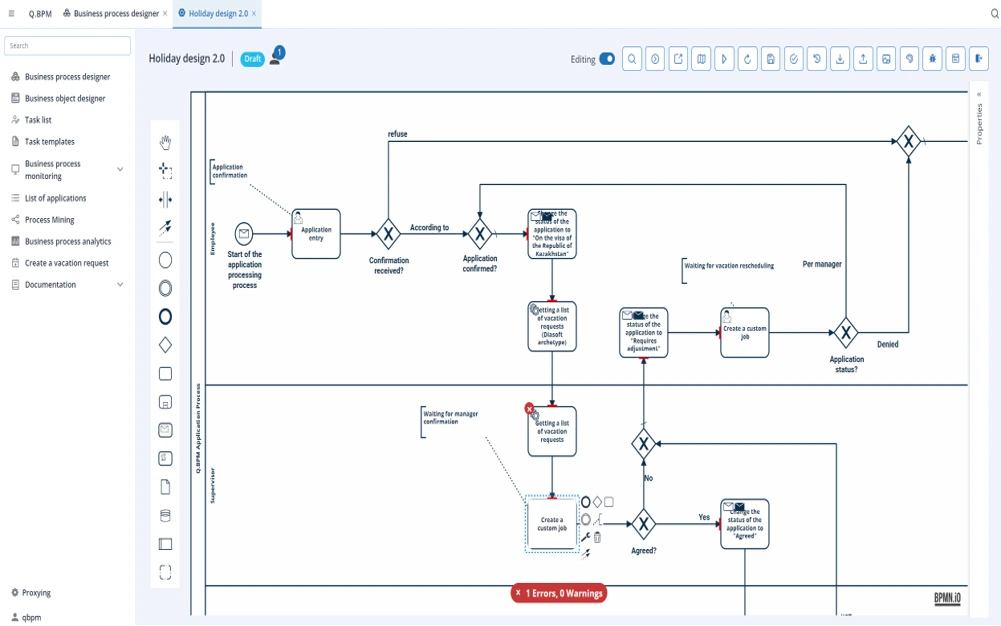

Digitize, manage, monitor and streamline

- Manage and improve your business processes with high-load Business Process Management and Monitoring tools

- Easily discover operational processes with Process Mining

- Design or customize ready-to-use Business Processes with Low-code/ No-code development tools

Boost your existing digital solutions, customer services and product management processes by adding cutting-edge digital components. Personalize and improve banking experience at branches and digital channels

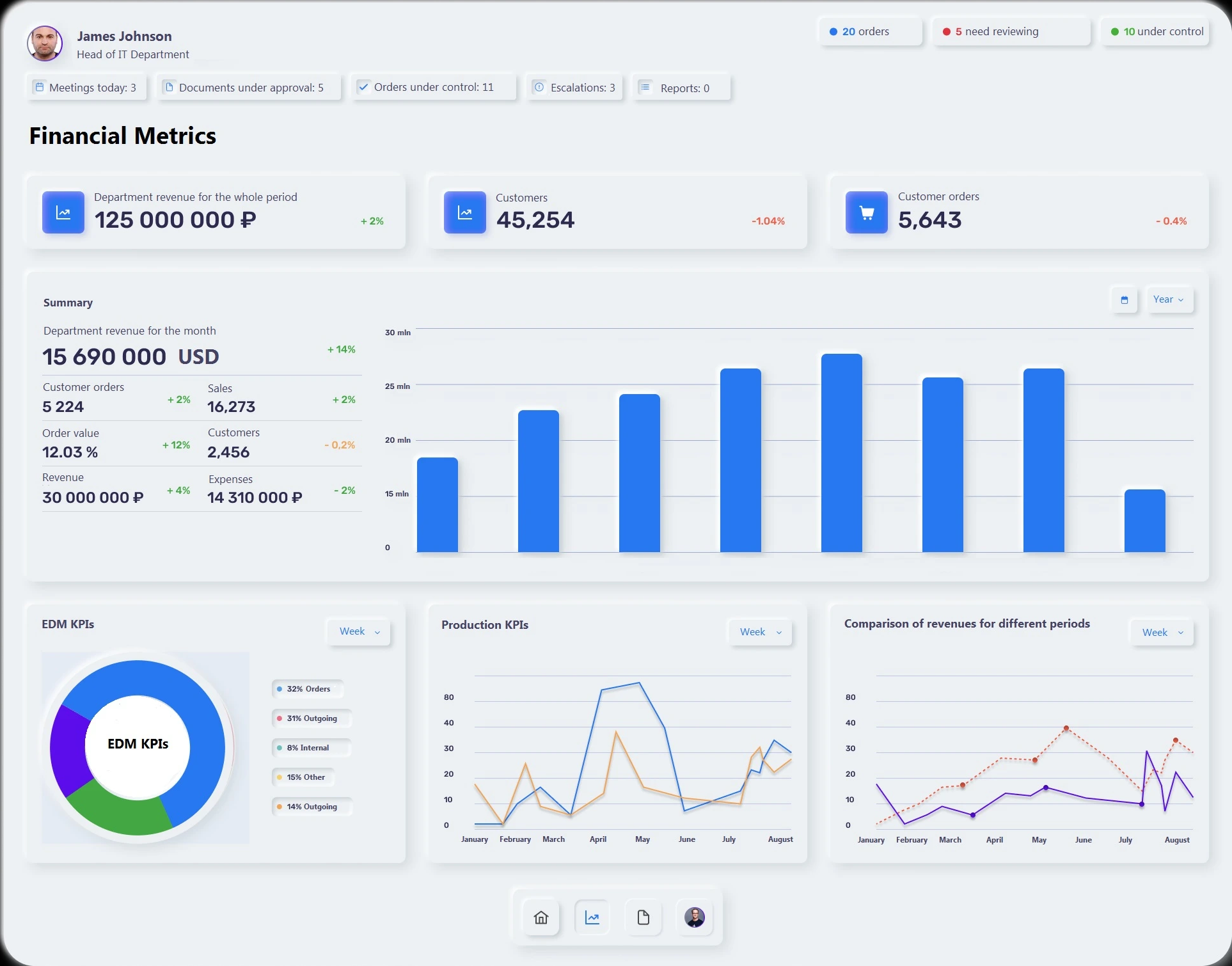

Visualize and analyze

- Visualize your data in custom interactive dashboards

- Track dependencies

- Take informed business decisions

- Quickly make business changes

Boost your existing digital solutions, customer services and product management processes by adding cutting-edge digital components. Personalize and improve banking experience at branches and digital channels

Game changer in product design, pricing and billing

- Enhance your existing customer service system

- Quickly design and launch new digital products and services

- Accelerate TTM of new products and services

- Make changes possible

- Easily create product bundles

collaborate

with us

Have an idea for collaboration?

Do you want to discuss the terms? Contact us

Let’s Discuss

Do you want to discuss the terms? Contact us

THE PLATFORM

THE PLATFORM

PRODUCTS

PRODUCTS

BUSINESS PROCESSES

BUSINESS PROCESSES

ACCELERATORS

ACCELERATORS

FinTech

FinTech