Why use a Product Factory?

-

Quickly design and launch new digital products and servicesBanks are striving for digital transformation to go in pace with the whirlwind business environment, but legacy core systems often do not allow easy digitalization.

Quickly design and launch new digital products and servicesBanks are striving for digital transformation to go in pace with the whirlwind business environment, but legacy core systems often do not allow easy digitalization. -

Accelerate TTM of new products and servicesDesign of new products in legacy systems often takes more than half a year. Financial institutions can quickly solve this task with the flexible microservice product factory that enables quick TTM regardless of the underlying core system.

Accelerate TTM of new products and servicesDesign of new products in legacy systems often takes more than half a year. Financial institutions can quickly solve this task with the flexible microservice product factory that enables quick TTM regardless of the underlying core system. -

Make changes possible and quickly implement and test your business ideas of any complexityClients expect financial services companies to offer new digital products that comprise more and more options, but current legacy systems cannot quickly support new product models due to their inflexibility and hard coding.

Make changes possible and quickly implement and test your business ideas of any complexityClients expect financial services companies to offer new digital products that comprise more and more options, but current legacy systems cannot quickly support new product models due to their inflexibility and hard coding. -

Easily create product bundlesCross-product bundles of bank and non-bank products are becoming more and more popular, but existing IT systems do not support the ability to combine products and services in product packages and enable flexible pricing.

Easily create product bundlesCross-product bundles of bank and non-bank products are becoming more and more popular, but existing IT systems do not support the ability to combine products and services in product packages and enable flexible pricing.

Product

Features

- Enable enterprise-wide product management and pricing with the centralized product information management (PIM) for all financial products and services.

- Flexibly configure and manage innovative digital products, services, product bundles, special offers, parameters and rates.

- Easily test new business ideas and models, select the most successful ones and make quick changes in other models.

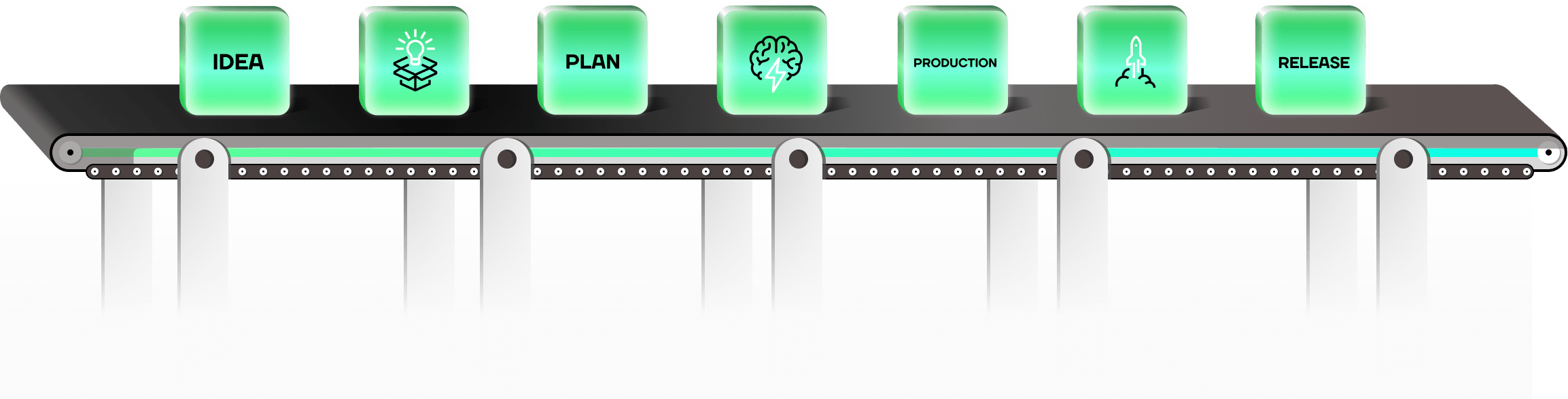

- Manage the whole product lifecycle starting from planning and designing of a new product to its launch to the market and dismissal.

- Implement flexible pricing and personalized offerings across geographies.

- Make your product offerings personal. Adapt quickly to market requirements or short-term trends. Launch special offers easily based on seasonal changes in customer behaviors, special and festive occasions: Christmas rush, low purchase activity during the summer, public events, etc.

- Boost your up-sale and cross-sale.

BUSINESS

CAPABILITIES

-

Setup of products, service plans, services, etc.Ability to copy products, create products from templates, inherit attributes from parent elements. Ability to set up product terms and conditions of any complexity.

Setup of products, service plans, services, etc.Ability to copy products, create products from templates, inherit attributes from parent elements. Ability to set up product terms and conditions of any complexity. -

Management of reference lists of product parametersStandardization and quick access to reference data for quick and accurate design of products.

Management of reference lists of product parametersStandardization and quick access to reference data for quick and accurate design of products. -

Management of product versionsMaintaining the history of product changes. Ability to use several product versions simultaneously (e.g., in case of release of a new service plan for new customers, the previous version of the plan is still supported for existing users).

Management of product versionsMaintaining the history of product changes. Ability to use several product versions simultaneously (e.g., in case of release of a new service plan for new customers, the previous version of the plan is still supported for existing users). -

Flexible and multi-product pricingUsing the rate calculator and calculated parameters of service plans, the company can flexibly support any calculation logic, even without coding.

Flexible and multi-product pricingUsing the rate calculator and calculated parameters of service plans, the company can flexibly support any calculation logic, even without coding. -

Setup of product bundlesAbility to include separate simple products to packages and partner offerings. Linking to existing products.

Setup of product bundlesAbility to include separate simple products to packages and partner offerings. Linking to existing products. -

Partner products and co-branding projectsPresentation of partner products and their marketing descriptions in the product mart.

Partner products and co-branding projectsPresentation of partner products and their marketing descriptions in the product mart. -

Centralized source of product dataIntegration with external systems for the access to aggregated product data. MDM/PIM.

Centralized source of product dataIntegration with external systems for the access to aggregated product data. MDM/PIM. -

Publishing products in marketplaces

Publishing products in marketplaces -

Management of the product lifecyclefrom market launch to archiving.

Management of the product lifecyclefrom market launch to archiving. -

Setup of links between separate productsproducts to boost cross-selling and up-selling.

Setup of links between separate productsproducts to boost cross-selling and up-selling. -

Management of contracts for product bundlesReporting. Management of product packages is a complicated process taking into account multiple interrelated parameters, that is why this function is normally not available in standard back-office system (product management, general ledger, core banking).

Management of contracts for product bundlesReporting. Management of product packages is a complicated process taking into account multiple interrelated parameters, that is why this function is normally not available in standard back-office system (product management, general ledger, core banking). -

Accounting for sold servicesThe information is then used to calculate fees that depend on the amount of delivered services.

Accounting for sold servicesThe information is then used to calculate fees that depend on the amount of delivered services. -

BillingCharging and tracking payments of calculated fees.

BillingCharging and tracking payments of calculated fees.

BREAKTHROUGH OPPORTUNITIES

FOR YOUR BUSINESS

-

Fast time-to-valueAccelerate product design with flexible settings instead of complex coding, long testing and releases.

Fast time-to-valueAccelerate product design with flexible settings instead of complex coding, long testing and releases.

Easily test new business ideas and change business models without restrictions of inflexible legacy solutions. -

Single version of the truthAggregate all product offerings from distributed systems and legacy solutions on a single platform and ensure centralized access to all product data.

Single version of the truthAggregate all product offerings from distributed systems and legacy solutions on a single platform and ensure centralized access to all product data. -

Product bundlesBreakthrough capabilities in setup and management of complex product bundles, that cannot be configured in standard core systems or CRM solutions.

Product bundlesBreakthrough capabilities in setup and management of complex product bundles, that cannot be configured in standard core systems or CRM solutions. -

Personalized products and servicesEasily set up and quickly edit special offers for specific clients and client groups instead of standard out-of-the-box products for all clients.

Personalized products and servicesEasily set up and quickly edit special offers for specific clients and client groups instead of standard out-of-the-box products for all clients.

SUPERB

PERFORMANCE

parameters

parameters

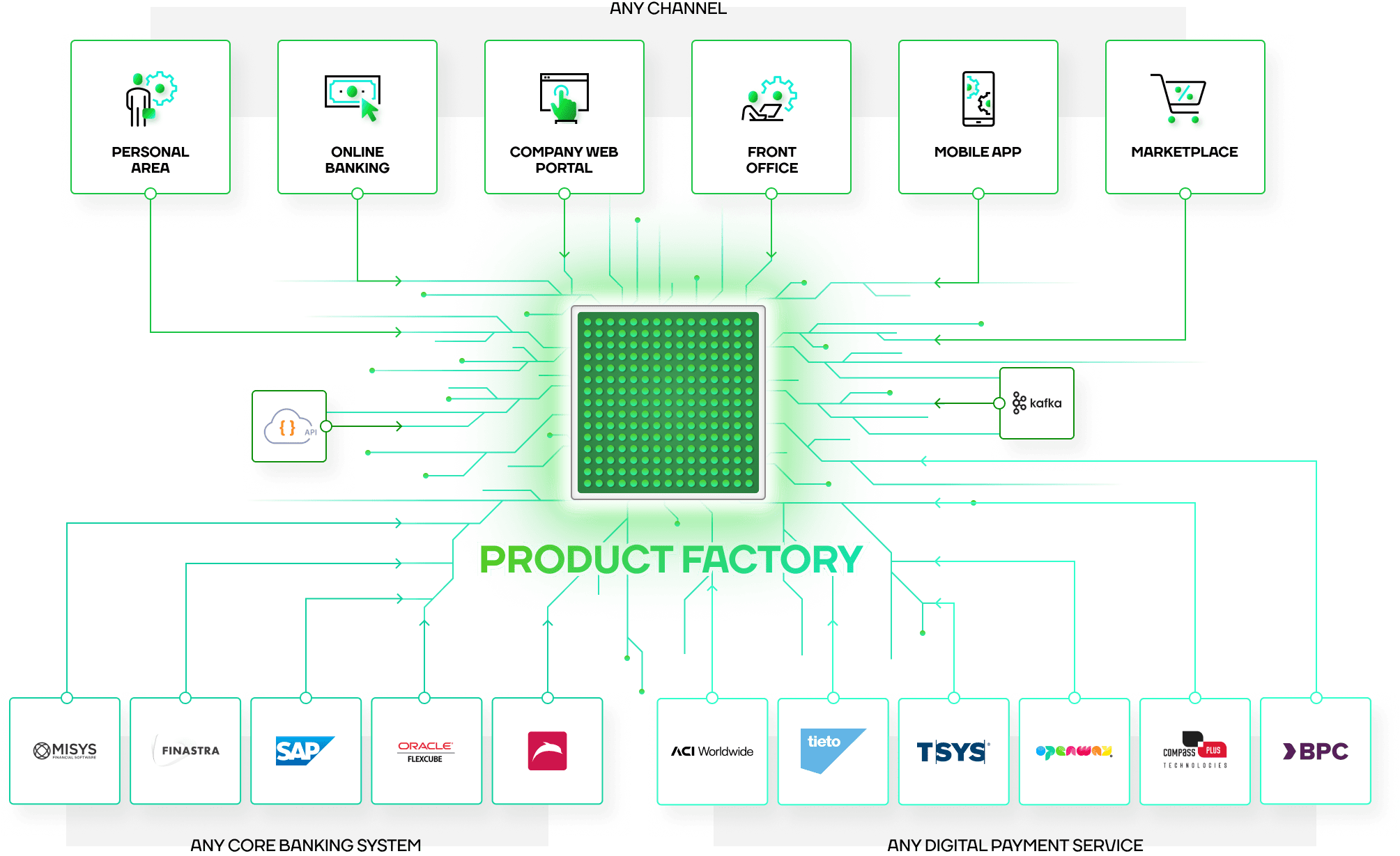

CORE AGNOSTIC

SOLUTION

-

Enterprise-wide product factory and product directory with the ability to maintain all

Enterprise-wide product factory and product directory with the ability to maintain all

products centrally and still support specific features across different locations. -

Ability to manage products across multiple core systems and run on large legacy

Ability to manage products across multiple core systems and run on large legacy

technology stacks. -

Independence from underlying back-office systems (product management, general

Independence from underlying back-office systems (product management, general

ledger, other accounting solutions). -

Access to modern product management features, such as quick launch of new

Access to modern product management features, such as quick launch of new

products and business models, even on top of legacy core systems. -

Easy integration into the existing IT landscape with the help of REST APIs and

Easy integration into the existing IT landscape with the help of REST APIs and

event-driven communication. -

Incremental development and step-by-step digital transformation instead of big-

Incremental development and step-by-step digital transformation instead of big-

bang modernization projects.

DIGITAL

ACCELERATOR

-

Loan origination

Loan origination

systemImplement Digital Q.ProductFactory into your loan origination system and enhance your lending processes with new features: credit calculator capabilities, automatic selection of credit products, flexible interest rates, special offers, bundled services. -

Branch

Branch

bankingEnhance your customer services with popular retail and corporate banking offerings: personalized products, bonuses, special offers on public and festive occasions, flexible money transfer rates, different types of deposits, ability to conveniently select products that will suit your customers in the best way. -

Digital

Digital

channelsBuild the product factory into your Internet and Mobile banking solutions to timely inform your customers on new product offerings, conveniently present product details. -

Marketplaces

Marketplaces

of financial servicesEasily publish information on your product offerings in external marketplaces and partner ecosystems and improve your customer reach. Provide your customers with the marketing and financial information in the most convenient way.

VARIETY OF

PRODUCTS

- Cross-sell

- Personalized offer

- Service plan

- Partner product

- Product

- Seasonal offering

- Up-sell

- Special offer

- Co-branding

- Multi-currency product

- Fee

- Product bundle

- Service

- Discount

BUSINESS

ARCHITECTURE

Designer

Product Bundles

Mart

Management

USE

cases

Easily combine separate products and services to create packaged, cross-product and individual offerings to better meet needs of your customers.

- A Complex Product (Product Package) combines several simple products or services that refer to different business lines. A complex product comprises the full list of services that belong to its nested products.

- A simple product can be included into any number of service packages.

- The system allows editing rates and terms of simple services when including them into a complex product.

The card issue fee of a simple card product is 5 USD.

If the card is included into a product package, the bank can issue up to 3 cards free of charge and then charge the fee of 5 USD for each extra card

(as defined by the rate of the simple product)

- Term

- Fee

- Price

- Other terms

Simple product

- Deposit

- Internet bank

- Debit Card

Complex productDeal package:

- Deposit

- Debit card

- Internet banking

Sold product

- Deposit

Upsell / Cross-sellUpsell:

- Deposit on special profitable terms

Cross-sell:

- Debit Card

Link and re-link services and products to bank transactions. When a customer initiates a transaction that has linked cross-sell or upsell options, the bank can offer to the customer respective linked services.

- Ability to set up complex pricing tiers and upsells and flexibly change fees depending on whether a customer buys a simple product or a product in addition to his/her existing products and services.

- Ability to set up links between products, services and transactions that belong to different lines of products to trigger cross-sell and upsell offerings.

A client selects to issue a Mastercard Classic card. In case of frequent use of the card or large add-ons to the card account, the bank can offer this customer to upgrade to the Mastercard Platinum card.

During sale of a deposit, the client can be offered to issue a debit card.

Flexibly manage your fees and pricing depending on your business goals.

Launch personalized or seasonal offerings. Test your business ideas and select what works the best for your business across different branches, geographies and lines of business.

- In simple cases, a product term can be defined as a fix value (e.g., the statement issue fee is 3 euro) or as a list of values (e.g., an account can be opened in one of the following currencies: EUR, USD, VND).

- In more complex cases, product terms can be set up with the help of billing rules.

- Setup of calculation formula (e.g., the fee for cash withdrawal via third-party devices makes 2% of the transaction amount, but no less than 0.50 euro).

- Defining how the result depends on selected parameters (e.g., the loan interest rate depends on the down payment amount: 6% – if the down payment is less than 1,500 euro; 6.5% – if the down payment is 1,500-7,000 euro; 7% – if the down payment is more than 7,000 euro).

- Usage of data from external systems: customer details, contract details, transaction details and any other related information (e.g., the interest rate of the savings account makes 8% if the minimum card balance in the previous reporting period was 1,000 euro or higher and there were purchase transactions made with this card; otherwise, the interest rate is 3%).

TECHNOLOGICAL

LEADERSHIP

-

Microservice

Microservice

architectureOur solutions were designed as small components, based entirely on the microservice architecture. This approach and built-in low-code development tools ensure independence from other solutions, high performance, ability to develop the system incrementally in pace with the business growth. Reduced cost of new products. -

No-code/

No-code/

low-code toolsThe solution architecture supports a flexible structure of product parameters and rates for different lines of business. Low-code tools allow setting up new products and service plans without the vendor. -

High performance powered by Red

High performance powered by Red

Hat OpenShift or KubernetesThe platform is capable to faultlessly process thousands of customer transactions per second. Ability to cope with non-stop calls to the database.

any questions?

Contact us

Contact Us

Request a demo

Download the product overview

Request the benchmark report

Register for the Webinar

Using a Product Factory to quickly design and launch digital products & services for your bank

Whatsapp our expert

Whatsapp our expert